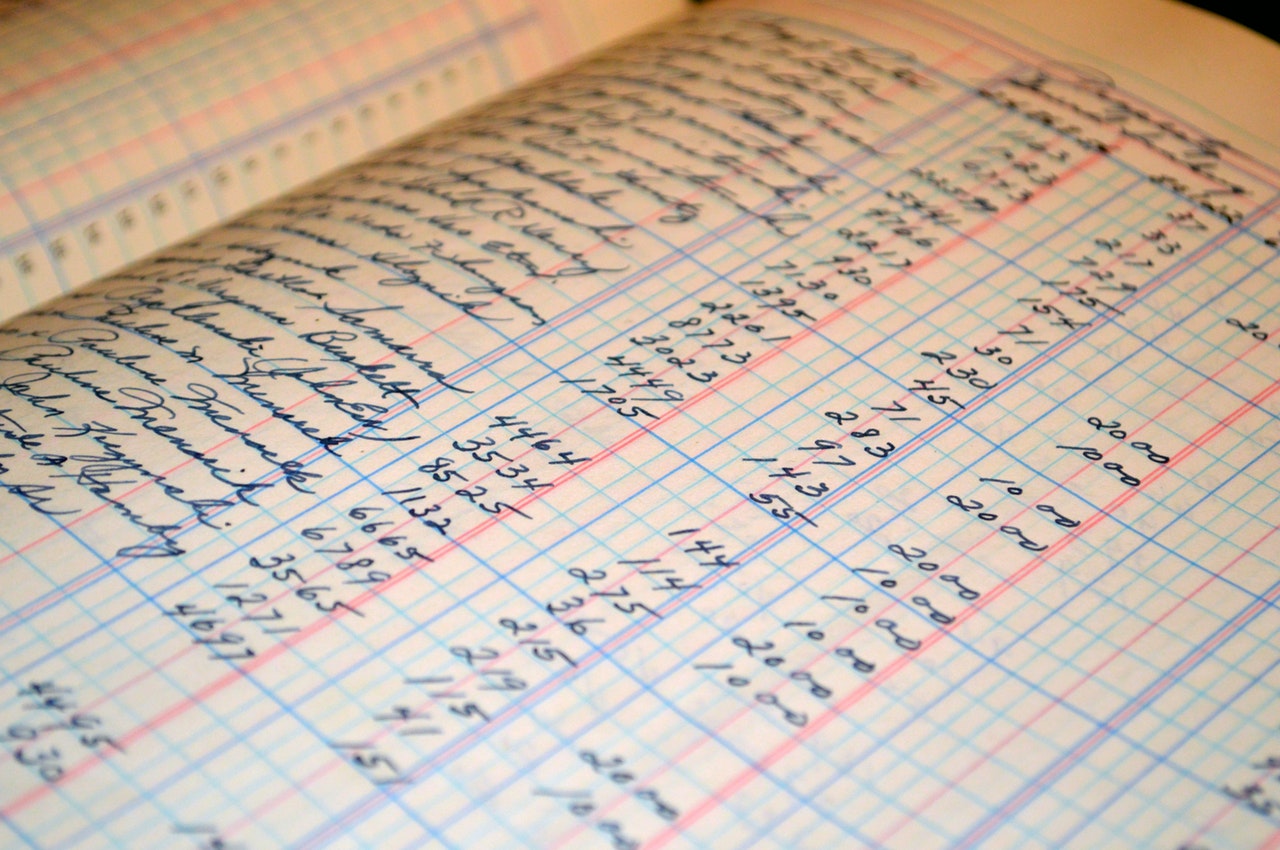

If you are a small business owner, and have not hired a bookkeeper, we strongly recommend QuickBooks Software to keep track of all of your bookkeeping financial transactions, including banking, invoicing, purchases, payroll and more. Though we studied accounting back in the day of the paper ledger method, we would never go back, as QuickBooks makes things so easy.

As a rule, we recommend that small business owners spend 10-15 minutes a day inputting daily transactions into this software, so it is guaranteed that time and frustration is saved during tax time…remember time=money that could be spent income-generating tasks.

In addition, you can quickly see your receivables and payables at a glance, so you know your financial standing, as well as have your payroll deposits and report filing completed automatically. (Keeping track of those deadlines can be a headache!)

UPDATE: If interpreting your business financials is overwhelming, we encourage you to check-out this resource: Accounting for the Numberphobic. A humorous, easy-read!