If you have visited my Resource Toolbox, you will know that I strongly recommend Dave Ramsey’s education on financial literacy. Understanding and properly managing finances is important for all people and businesses, but it is especially crucial for small business owners, where the line between personal and business finances can become very blurred. It is challenging to build a business as an entrepreneur, without using personal funds, and perhaps those of family members.

As a note, for helping to set definitive lines between your personal and business finances, it is recommended that you keep separate banking and bookkeeping records for each. Personally, I do not like the hassle of having two accounts, so I keep one set of records in my QuickBooks; however, I clearly define any personal expenses as “equity draws” to eliminate any inadvertent mis-categorizing of business expenses. Likewise, I label any “real job” income as “equity investments,” as my employer already deducts taxes, and I do not want to inadvertently pay double taxes. 🙂

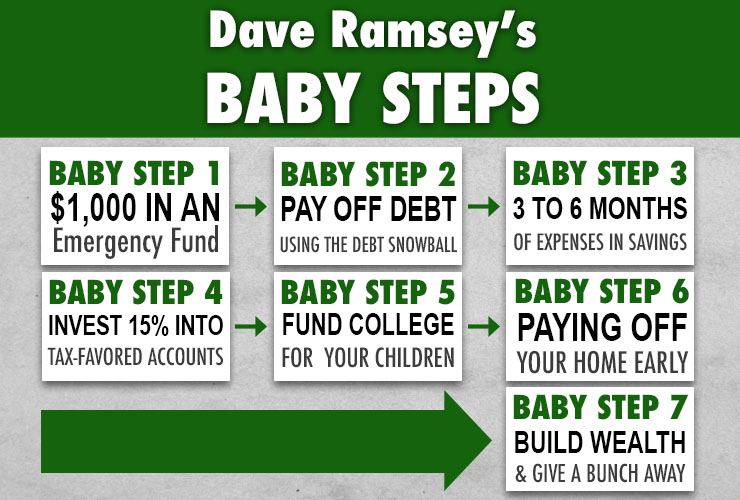

Anyway, in regards to my Ramsey education, I was first introduced over 15 years ago, when I purchased the high school curriculum for my son. Since then, I have worked diligently to get through Ramsey’s Baby Steps. A couple of years ago, I had completed Baby Step 2…paying off debt. Unfortunately, building a business and supporting a child in college took me back to Step 1. Thankfully, I gave my son a head start. He has recently graduated from college, and learned this week, when his front tire exploded (thankfully, without an accident), how important having $1000 in an emergency fund is for such events. So, here we are, together working on Baby Step 2…mine for the second time. But, I have done it once, so I have more confidence I can do it again, for good this time. Within a year, my son and I should be on to Baby Step 3…and now that college is done, I get to skip Baby Step 5. 😀 (As mentioned in my Financial Literacy Toolbox Resource, I strongly recommend downloading and regularly updating this Microsoft Excel Snowball Calculator. It is a great tool during Step 2, to create a motivating debt reduction snowball, and remind yourself to stay on track. I keep it open on my desktop at all times, so it is a constant reminder of my goals.)

No matter what your business, the ultimate goal for all of us ensuring sufficient retirement savings, so as not to worry about finances in our “golden years.” As Dave says, “Live like no one else now so later you can live like no one else.” As the availability of Social Security income is uncertain 20+ years from now, it is important that we are wise with our finances today. Another great tool is Ramsey’s Investment & Retirement Calculator. Again, I keep this shortcut on my desktop to visit regularly. (I find that shortcuts that are hidden in my Bookmark menu rarely get visited…I need things “in my face,” hence my love of a pocketful of sticky notes.) I am not at Baby Step 4 yet, but I am mentally preparing. There are great tips at the bottom of the calculator, such as, “What if I do not buy that daily fancy coffee? How much more would that provide to me at retirement? What about forgoing that weekly dining out expense?”

Obviously, as small business owners, we are all going to have unavoidable personal and business expenses. However, to ensure the success of our future, we need to start thinking wisely today. We need to start actively budgeting, eliminating the burden of debt, and starting to invest for our retirement today. It is simply a change of mindset. Instead of satisfying our desires today, if we can develop the habit of delaying gratification, it will make all the difference for our future financial situation. (If delaying gratification is a true challenge, I recommend moving to a rural area. Not having access to fast food, shopping, fancy coffee, or even a convenience store open after 8 p.m. is a great help in forcing you into a spending “cooling down” period…as long as you are not a late night Internet or TV shopper.)

Of course, by no means does this not mean you cannot treat yourself every so often. Entertainment expenses are recommended to be built into your monthly budget…otherwise you will become discouraged, and perhaps give up. As long as we keep our mind on the end goal, we can be successful. Even if we have to repeat a Baby Step…

UPDATE 2023: I’m excited to announce, that five years after writing this post, I’ve finally made it to Baby Step 6. It took a lot of sacrifice, but the freedom is priceless!

Until next issue…Best wishes in your endeavors!